Use the information for the question(s)below.

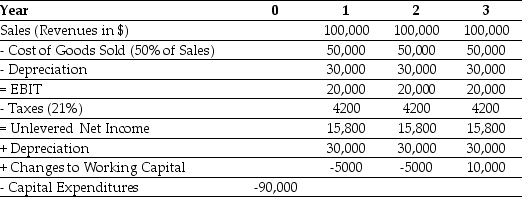

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Mental Effects

The impact on or changes in cognitive, emotional, and psychological states of an individual.

Stagnation

A state of inactivity or lack of progress and development, often used in psychological contexts to describe periods of life where growth is perceived to halt.

Muscle Mass

The total amount of skeletal muscle in an individual's body, crucial for physical strength and overall health.

Extra Pounds

A term often used to refer to additional weight that a person carries, typically considered to be beyond what is healthy or normal for their body type and height.

Q9: Your estimate of the asset beta for

Q11: Perrigo's book value of equity is closest

Q17: If the risk-free rate of interest (rf)is

Q24: Assuming that you have made all of

Q29: Which of the following formulas is INCORRECT?<br>A)g

Q31: If the risk-free rate of interest (rf)is

Q53: Wyatt Oil's average historical excess return is

Q55: The beta for the market portfolio is

Q62: The standard deviation of the overall payoff

Q85: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="Consider