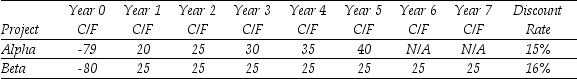

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The NPV for project Alpha is closest to:

Definitions:

Quarterly Returns

The investment gains or losses experienced by an asset or portfolio over a three-month period.

Geometric Average Return

A method of calculating the average rate of return that accounts for the compounding of returns over time.

Quarterly Returns

The investment gains or losses recorded by a fund or portfolio over a three-month period.

Standard Deviation

A statistical measure of the dispersion or variability of a set of data points, often used in finance to quantify the risk associated with a specific investment.

Q6: The beta for security "Y" is closest

Q14: A project you are considering is expected

Q34: Assuming you pay the points and borrow

Q34: Which of the following statements is FALSE?<br>A)Fluctuations

Q54: If an investment providing a nominal return

Q58: The profitability index for this project is

Q62: You are offered an investment that pays

Q67: Which of the following statements is FALSE?<br>A)In

Q71: Which of the following statements is TRUE?<br>A)Small

Q78: Which of the following statements regarding arbitrage