Use the table for the question(s) below.

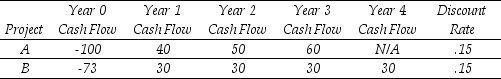

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project A is closest to:

Definitions:

Horizontal Transfer

The movement or application of skills and knowledge across similar tasks or contexts at the same level of complexity.

Vertical Transfer

The movement or sharing of skills, knowledge, or information from higher to lower levels within an organization, or vice versa.

Distinguish

To recognize or point out differences between two or more items, concepts, or phenomena, often highlighting unique or distinguishing characteristics.

Management

Management involves the planning, organizing, directing, and controlling of resources, such as personnel, finances, and assets, to achieve organizational goals efficiently and effectively.

Q33: Draw a timeline detailing the cash flows

Q34: How much will each semiannual coupon payment

Q41: What is the excess return for the

Q46: Assume that your capital is constrained,so that

Q49: A default-free security has an annual coupon

Q51: Which of the following statements is FALSE?<br>A)When

Q54: Which of the following statements is FALSE?<br>A)Even

Q60: What is the excess return for Treasury

Q64: Which of the following balance sheet equations

Q88: Luther Industries has a market capitalization of