Use the table for the question(s) below.

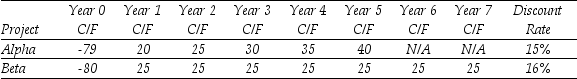

Consider the following two projects with cash flows in $:

-Assume that projects Alpha and Beta are mutually exclusive.The correct investment decision and the best rationale for that decision is to:

Definitions:

Consumer's Surplus

The difference between the total amount that consumers are willing and able to pay for a good or service versus the total amount they actually pay.

Earplugs

Small devices inserted into the ear canal to protect the ears from loud noises, water, or to block out sound for concentration or sleep.

Utility Function

Mathematical model that quantifies satisfaction levels consumers receive from consuming various quantities of goods and services, guiding choices under constraint.

Consumer's Surplus

The gap between what consumers are prepared and capable of spending for a product or service and the aggregate sum they end up paying.

Q4: The NPV of an investment that costs

Q10: Assuming you currently have 10,000 Bbls of

Q14: Explain why the NPV decision rule might

Q19: The NPV for Boulderado's snowboard project is

Q20: Which of the following statements is TRUE?<br>A)Prices

Q40: Which of the following statements is FALSE?<br>A)The

Q65: The standard deviation for the return on

Q66: For the year ending December 31,2019 Luther's

Q76: Which of the following statements is FALSE?<br>A)When

Q86: Consider two securities,A & B.Suppose a third