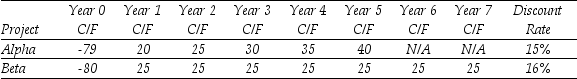

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-Assume that projects Alpha and Beta are mutually exclusive.Which of the following statements is true regarding the investment decision tools' suitability for deciding between projects Alpha & Beta?

Definitions:

Mutual Funds

Investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Corporate America

A term often referring to the United States' major business corporations and their practices, influence on the economy, and role in society.

Diverse Stock Portfolio

An investment strategy that involves holding a variety of different stocks to reduce risk.

Small Investors

Small investors refer to individual or retail investors who invest smaller amounts of money in securities, often lacking the market influence of larger institutional investors.

Q4: Which of the following adjustments to net

Q6: The payback period for project Alpha is

Q21: When choosing between projects,an alternative to comparing

Q25: Which of the following statements is FALSE?<br>A)The

Q27: If the current rate of interest is

Q31: Which of the following statements is FALSE?<br>A)In

Q53: If Krusty Krab's opportunity cost of capital

Q59: The payback period for project Beta is

Q67: The inventory days ratio measures:<br>A)the average length

Q111: The variance on a portfolio that is