Use the table for the question(s)below.

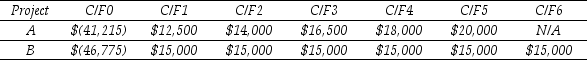

Consider two mutually exclusive projects with the following cash flows:

-What is one of the incremental IRRs for project B over project A? Would you feel comfortable basing your decision on the incremental IRR?

Definitions:

Blacklist Policy

A practice where individuals or entities are denied certain opportunities, services, or recognition due to political views, particularly during the McCarthy era in Hollywood.

Hard-boiled Pulp

A genre of literature and film characterized by tough, cynical characters and bleak, sleazy settings, often involving crime and moral ambiguity.

American Genres

Categories of films that have become distinctively recognized within American cinema, including Westerns, film noir, and musicals, reflecting aspects of American culture and history.

Ancillary Market

These are secondary markets for films, including home video, television broadcasts, and merchandise, which can significantly contribute to a film's overall revenue.

Q5: At an annual interest rate of 7%,the

Q18: In a normal market with transactions costs,is

Q22: Gross profit is calculated as:<br>A)Total sales -

Q36: The IRR for Boulderado's snowboard project is

Q68: Which of the following statements is FALSE?<br>A)A

Q75: What do you anticipate will happen to

Q76: If the current rate of interest is

Q77: Which of the following statements is FALSE?<br>A)Investors

Q90: For the year ending December 31,2019 Luther's

Q117: Consider a portfolio consisting of only Microsoft