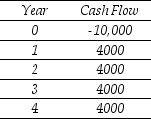

Use the table for the question(s) below.

Consider a project with the following cash flows in $:

-Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

Definitions:

Underwriting Spread

The underwriting spread is the difference between the amount underwriters pay to the issuer in a securities offering and the price at which the securities are sold to the public, serving as compensation for the underwriters.

Issue Costs

Costs related to the creation of new securities, encompassing fees for underwriting, legal services, and registration.

Stock Price

Stock price is the amount of money required to purchase a share of a company's stock, fluctuating based on supply, demand, and market sentiment.

Subscription Price

The cost at which existing shareholders can purchase additional shares in a company, often at a discount during a rights issue.

Q12: Which of the following statements regarding the

Q18: Consider an equally weighted portfolio that contains

Q42: The present value (at age 30)of your

Q61: On the balance sheet,short-term debt appears:<br>A)in the

Q66: What is the excess return for corporate

Q77: Which of the following statements is FALSE?<br>A)FV

Q77: The incremental unlevered net income in the

Q78: Which of the following is NOT a

Q80: Suppose that if GSI drops the price

Q91: Perrigo's earnings per share (EPS)is closest to:<br>A)$0.19.<br>B)$1.79.<br>C)$2.81.<br>D)$3.76.