Use the table for the question(s) below.

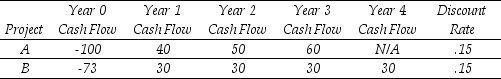

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project A is closest to:

Definitions:

Liquidation Of Assets

This process involves converting assets into cash or cash equivalents by selling them, typically during the winding down or bankruptcy of a business.

Common Shareholders

Individuals or entities that hold common stock in a corporation, entitling them to dividends and voting rights, but placing them last in priority for company assets in case of liquidation.

Dissolve

To formally end or terminate an entity, such as a corporation, partnership, or marriage, through legal means.

Outstanding Common Shares

The total number of common shares of a corporation that are issued and currently held by shareholders.

Q3: The beta for the risk-free investment is

Q5: Because of a catastrophic plane crash,the FAA

Q6: The beta for security "Y" is closest

Q7: The beta for Sisyphean's new project is

Q18: Suppose that you want to use the

Q22: Consider a growing perpetuity that will pay

Q39: Suppose that the risk-free rate is 5%

Q42: The beta for the portfolio of the

Q44: Zoe Dental Implements has gross property,plant and

Q94: The expected return for Rearden Metal is