Use the table for the question(s)below.

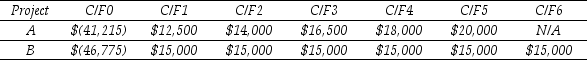

Consider two mutually exclusive projects with the following cash flows:

-If the discount rate for project B is 15%,then what is the NPV for project B?

Definitions:

Hippocrates

An ancient Greek physician often regarded as the father of Western medicine, known for the Hippocratic Oath.

Body Fluids

Liquids produced by the body that have various functions, including blood, saliva, and digestive juices.

Chemical Communication Systems

The transfer of information among organisms through the release and reception of chemical signals.

Blood

A vital fluid in humans and animals that delivers necessary substances such as nutrients and oxygen to cells and transports metabolic waste products away.

Q3: Which of the following statements is FALSE?<br>A)The

Q24: The distinguishing feature of a corporation is

Q25: The price today of a two-year default-free

Q27: The cost of capital for a project

Q38: Assuming that Dewey's cost of capital is

Q49: You are considering purchasing a new home.You

Q69: What is the expected return for an

Q74: Which of the following statements is FALSE?<br>A)Because

Q82: Which of the following statements regarding perpetuities

Q106: The forward rate for year 5 (the