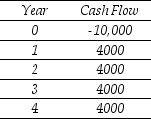

Use the table for the question(s) below.

Consider a project with the following cash flows in $:

-Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

Definitions:

Cognitive Reactions

Mental responses or thoughts that occur in response to a situation or information.

Traumatic Experience

An event that causes psychological distress and can lead to long-term mental health issues like PTSD.

Social Psychologists

Experts who study how individuals think, influence, and relate to one another within the context of society.

Effective Functioning

The optimal operation of systems, organs, or processes, ensuring they perform their intended duties successfully and efficiently.

Q15: Wyatt Oil is contemplating issuing a 20-year

Q27: If the discount rate is 15%,the alternative

Q33: Assuming that the risk-free rate is 4%

Q42: Which of the following statements is FALSE?<br>A)The

Q60: Which of the following statements is FALSE?<br>A)A

Q62: Which of the following formulas is INCORRECT?<br>A)Yield

Q72: If the appropriate interest rate is 8%,then

Q91: The standard deviation for the return on

Q96: Which of the following statements is FALSE?<br>A)In

Q100: The standard deviation of the overall payoff