Multiple Choice

Use the table for the question(s) below.

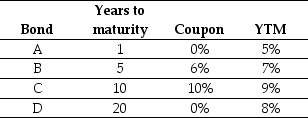

Consider the following four bonds that pay annual coupons:

-The amount that the price of bond "D" will change if its yield to maturity increases from 8% (Price0) to 9%(Price1) is closest to:

Definitions:

Related Questions

Q12: Which of the following statements is FALSE?<br>A)We

Q13: Dagny Taggart is a graduating college senior

Q18: The effective annual rate (EAR)for a loan

Q33: Which of the following statements regarding profitable

Q44: The Sharpe Ratio for Wyatt Oil is

Q66: What is the excess return for corporate

Q74: The expected return on security "Y" is

Q83: If the appropriate interest rate is 8%,then

Q85: How does scenario analysis differ from sensitivity

Q86: Ignoring the original investment of $5 million,what