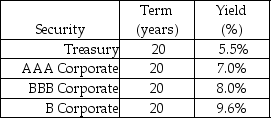

Use the following information to answer the question(s) below.

-Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons,a coupon rate of 8%,and a face value of $1000.Wyatt Oil believes it can get a AAA rating from Standard and Poor's for this bond issue.If Wyatt Oil is successful in getting a AAA rating,then the issue price for these bonds would be closest to:

Definitions:

Notice-And-Comment Rulemaking

A process by which U.S. federal agencies formally propose, receive, and consider public comments on a proposed regulation before it becomes final.

Administrative Agency

A government agency responsible for the oversight and administration of specific functions, such as regulation or enforcement of laws and policies.

Legal Standards

Established principles and criteria in the legal system that guide the conduct of legal cases and the administration of justice.

Regulatory Flexibility Act

A U.S. law that aims to minimize the impact of regulations on small businesses and other small entities by requiring federal agencies to consider less burdensome alternatives.

Q6: What is the effective after-tax rate of

Q16: If the ETF is currently trading for

Q25: A decrease in the sales of a

Q27: A tax-free municipal bond pays an effective

Q34: The number of potential IRRs that exist

Q52: The price of a five-year,zero-coupon,default-free security with

Q59: Which of the following equations is INCORRECT?<br>A)

Q61: On the balance sheet,short-term debt appears:<br>A)in the

Q86: Consider two securities,A & B.Suppose a third

Q92: An exploration of the effect on NPV