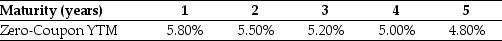

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 3 (the forward rate quoted today for an investment that begins in two years and matures in three years) is closest to:

Definitions:

Doppler Ultrasound Stethoscope

An instrument that combines ultrasound technology with a stethoscope to measure and listen to blood flow in arteries and veins.

Absent Pulse

A condition where no heartbeat is felt on palpation at a specific site, indicating a potential emergency or cardiac arrest.

Tympanic Temperature

Body temperature measured with a thermometer inserted into the ear canal, reflecting the internal body temperature.

Pinna

The visible part of the outer ear that captures sound waves and directs them into the ear canal.

Q3: Consider a five-year,default-free bond with an annual

Q24: Assuming that you have made all of

Q27: A tax-free municipal bond pays an effective

Q30: If your new strip mall will have

Q38: What is the NPV of an investment

Q49: The Dodd-Frank Wall Street Reform and Consumer

Q52: The price of a five-year,zero-coupon,default-free security with

Q79: If you want to value a firm

Q82: If your new strip mall will have

Q114: Assuming the appropriate YTM on the Sisyphean