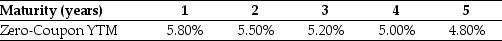

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 4 (the forward rate quoted today for an investment that begins in three years and matures in four years) is closest to:

Definitions:

Market Reforms

Market reforms refer to changes made to an economy with the goal of improving efficiency and growth by increasing the role of market forces (supply and demand) in determining the production and distribution of goods and services.

Elite Democratic Camp

A political concept pertaining to a group within the democratic system that holds significant influence or power, often through economic or social status.

Deregulation

The process of removing government regulations and restrictions from certain areas of business or sectors of the economy to encourage efficiency and competition.

Q12: Which of the following statements is FALSE?<br>A)The

Q13: Dagny Taggart is a graduating college senior

Q15: An incremental IRR of Project B over

Q48: Money that has been or will be

Q51: For which of the following products or

Q76: Which of the following statements is FALSE?<br>A)When

Q89: Wyatt Oil has a net profit margin

Q91: The change in Net working capital from

Q92: Which of the following formulas is INCORRECT?<br>A)P0

Q99: Luther Corporation's stock price is $39 per