Use the following information to answer the question(s) below.

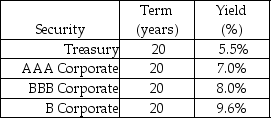

-Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons,a coupon rate of 7%,and a face value of $1000.Wyatt Oil believes it can get a BBB rating from Standard and Poor's for this bond issue.If Wyatt Oil is successful in getting a BBB rating,then the issue price for these bonds would be closest to:

Definitions:

Telecommunications Systems

Networks and technologies designed for the long-distance transmission of information, such as telephone, radio, and internet systems.

Legal Action

A process by which a court of law is involved in resolving disputes, enforcing laws, or protecting rights and properties.

Flak

Criticism or opposition, especially as a reaction to a public statement, policy, or action.

Philip Morris

An American multinational cigarette and tobacco manufacturing company, known for its Marlboro brand.

Q6: Consider a zero-coupon bond with a $1000

Q8: Which of the following statements regarding the

Q31: Consider the following time line: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg"

Q41: Luther Corporation's stock price is $39 per

Q42: If Moon Corporation has an increase in

Q50: The NPV profile graphs:<br>A)the project's NPV over

Q52: The price of a five-year,zero-coupon,default-free security with

Q69: MJ LTD is expected to grow at

Q81: The firm's revenues and expenses over a

Q89: The depreciation tax shield for the Sisyphean