Use the information for the question(s) below.

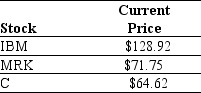

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-An American Depository Receipt (ADR) is a security issued by a U.S.bank and traded on a U.S.stock exchange that represents a specific number of shares of a foreign stock.Siemens AG has an ADR that trades on the NYSE and is equivalent to one share of Siemens AG trading on the Frankfurt Stock Exchange in Germany.If semens trades for $95.19 on the NYSE and for €64.10 on the Frankfurt Stock Exchange,then under the law of one price,the current exchange rate is closest to:

Definitions:

Q10: The internal rate of return (IRR)for project

Q15: Which of the following organization forms for

Q19: The largest stock market in the world

Q22: The profitability index for project B is

Q25: Consider the following list of projects: <img

Q27: A tax-free municipal bond pays an effective

Q48: Reverse innovation begins by identifying new product

Q55: A business identifies its key area of

Q70: Which of the following statements is FALSE?<br>A)If

Q103: Explain why the expected return of a