Use the information for the question(s)below.

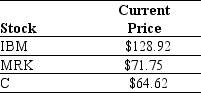

An exchange traded fund (ETF)is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM),three shares of Merck (MRK),and three shares of Citigroup Inc.(C).Suppose the current market price of each individual stock are shown below:

-Assume that the ETF is trading for $670.00,what (if any)arbitrage opportunity exists? What (if any)trades would you make?

Definitions:

Inductive Reasoning

A method of reasoning in which the premises are viewed as supplying some evidence, but not full assurance, of the truth of the conclusion.

Bloom's Taxonomy

A hierarchical classification of the different levels of thinking skills, ranging from simple recall of facts to complex evaluation and creation.

Surrealist

Pertaining to surrealism, an artistic and literary movement that sought to release the creative potential of the unconscious mind by emphasizing irrational juxtaposition of images.

Dadaist

Pertains to an individual associated with Dadaism, an avant-garde art movement in the early 20th century that challenged traditional concepts of art and society.

Q4: Assuming that Dewey's cost of capital is

Q13: What are the four financial statements that

Q13: If the value of security "C" is

Q27: Which of the following organization forms accounts

Q63: The price today of a 3-year default-free

Q66: The incremental unlevered net income of the

Q67: You have been offered the following investment

Q74: If RBC acquires POP,in what year will

Q81: The firm's revenues and expenses over a

Q94: The NPV of manufacturing the armatures in-house