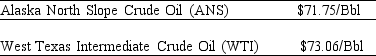

Use the information for the question(s) below.  As an oil refiner,you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil.Because of its lower sulfur content,you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner,you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil.Because of its lower sulfur content,you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

-Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS) crude oil for 10,000 Bbls of West Texas Intermediate (WTI) crude oil.Assuming you currently have 10,000 Bbls of WTI crude,the added benefit (cost) to you if you take the trade is closest to:

Definitions:

Chinese Descent

Refers to individuals whose ancestors originated from China, possessing cultural, genetic, or national ties to the country.

European Descent

Referring to people whose ancestral origins are found in Europe.

Ambiguous Faces

Visual stimuli that can be interpreted in more than one way and are often used in psychological experiments to study perception and emotion.

Outgroup Homogeneity

The perception that members of an outgroup are more similar to each other than they actually are, as compared to the ingroup's diversity.

Q4: Explain the benefits of incorporation.

Q7: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="Consider

Q21: The net price a business can derive

Q22: Businesses exercise greater control over service quality

Q29: The British government has just issued a

Q35: The present value of the lease payments

Q48: As a business builds more of the

Q63: The price today of a 3-year default-free

Q79: When we express the value of a

Q98: Which of the following is NOT an