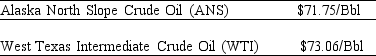

Use the information for the question(s) below.  As an oil refiner,you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil.Because of its lower sulfur content,you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner,you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil.Because of its lower sulfur content,you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

-Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS) crude oil for 10,000 Bbls of West Texas Intermediate (WTI) crude oil.Assuming you just purchased 10,000 Bbls of WTI crude at the current market price,the added benefit (cost) to you if you take the trade is closest to:

Definitions:

Overapplied

A situation in managerial accounting where the allocated indirect costs exceed the actual indirect costs incurred.

Underapplied

A situation where the allocated manufacturing overhead costs are less than the actual overhead costs incurred, indicating an underestimation of costs.

Actual Overhead

Actual overhead refers to the real costs incurred for indirect labor, materials, and other expenses necessary to run a business but not directly tied to specific products.

Service Provider

An entity that provides services to other entities, typically in exchange for payment.

Q7: Which of the following is a favorable

Q17: The payback period for this project is

Q17: Which of the following statements is FALSE?<br>A)The

Q32: Larry should:<br>A)reject the offer because the NPV

Q48: You are considering using the incremental IRR

Q52: The price of a five-year,zero-coupon,default-free security with

Q56: If the appropriate interest rate is 15%,then

Q59: _ is the ratio of the percentage

Q64: A 4-year default-free security with a face

Q72: Which of the following statements is FALSE?<br>A)Given