Use the information for the question(s) below.

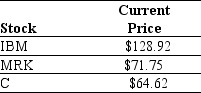

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-Suppose that the ETF is trading for $666.95;you should:

Definitions:

Survival Threats

Situations or conditions that pose significant risk to the continued existence or well-being of an individual or species.

Operant Conditioning

A learning process in which the strength of a behavior is modified by reinforcement or punishment.

Classical Conditioning

An educational method where two stimuli are consistently associated with each other, resulting in a reaction initially triggered by the second stimulus being subsequently triggered by the first stimulus alone.

Dissociative Disorders

Mental health conditions characterized by a disconnection between thoughts, identity, consciousness, and memory.

Q7: Dolan Corporation has Gross Profit of $2.3

Q8: The effective annual rate (EAR)for a savings

Q20: When the management team noted the increased

Q31: Red Hot Mexican Grill,a chain of Mexican-style

Q31: Which of the following statements is FALSE?<br>A)In

Q38: The cost of using direct marketing channels

Q49: Which of the following is a customer

Q53: You are in the process of purchasing

Q90: For the year ending December 31,2019 Luther's

Q96: Which of these bonds sells at a