Use the information for the question(s) below.

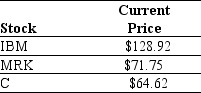

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-An American Depository Receipt (ADR) is a security issued by a U.S.bank and traded on a U.S.stock exchange that represents a specific number of shares of a foreign stock.Siemens AG has an ADR that trades on the NYSE and is equivalent to one share of Siemens AG trading on the Frankfurt Stock Exchange in Germany.If semens trades for $95.19 on the NYSE and for €64.10 on the Frankfurt Stock Exchange,then under the law of one price,the current exchange rate is closest to:

Definitions:

Code Repository

A storage location for software source code, allowing for version control and collaboration among developers.

Development Environment

A set of processes and programming tools used for developing applications and software.

Designer

A professional who creates plans and aesthetics for objects, environments, or visual communications, often with a focus on functionality and user experience.

Art Background

Graphical or aesthetic enhancements used as the backdrop for digital content, emphasizing creativity and visual appeal.

Q3: Which of the following is true of

Q15: If Alex Corporation takes out a bank

Q25: You have an investment opportunity in Germany

Q41: The yield to maturity for the two-year

Q43: Which of the following formulas is INCORRECT?<br>A)Invoice

Q52: The price of a five-year,zero-coupon,default-free security with

Q56: _ pricing allows buyers of a product

Q59: Which of the following is true of

Q61: At an annual interest rate of 7%,the

Q87: Suppose that a young couple has just