Use the following information to answer the question(s)below.

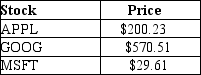

An exchange traded fund (ETF)is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL),one share of Google (GOOG),and ten shares of Microsoft (MSFT).Suppose the current stock prices of each individual stock are as shown below:

-If the ETF is currently trading for $1300,what arbitrage opportunity is available? What trades would you make?

Definitions:

Geological Research

The scientific study of the Earth, including its composition, structure, processes, and history.

Authority

The power or right to give orders, make decisions, and enforce obedience.

Tax Incentives

Financial benefits, such as reductions in taxes, provided by governments to encourage certain economic activities or investments.

High-Tech Manufacturing

A sector of industry that involves the production of goods using advanced technological processes and equipment, often associated with electronics, aerospace, and pharmaceuticals.

Q5: What rating must Luther receive on these

Q12: Which of the following statements is FALSE?<br>A)The

Q13: Which of the following organization forms accounts

Q21: The best way to identify groups of

Q35: If the risk-free rate of interest (rf)is

Q53: Explain how channel systems build customer value.

Q53: The NPV for project Alpha is closest

Q70: You are considering investing in a zero

Q77: Which of the following statements is FALSE?<br>A)Investors

Q90: For the year ending December 31,2019 Luther's