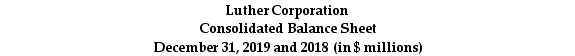

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2019 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2009 is closest to:

Definitions:

Invasion of Privacy

Unauthorized access or disclosure of personal information, or intrusive actions that violate someone's personal space or confidentiality.

Patient's Belongings

Personal items and effects that are owned and brought to a healthcare setting by a patient.

Maintain Patient Confidentiality

The ethical and legal duty of healthcare providers to keep a patient's personal and medical information private.

Portable Computer Station

A movable setup designed to accommodate a computer and its peripherals, enabling mobile computing environments.

Q9: Which of the following statements is FALSE?<br>A)The

Q15: Hugh Akston took out a 30-year mortgage

Q31: Logic teach Inc. ,a software manufacturing firm,specializes

Q35: How do you calculate (mathematically)the present value

Q36: You have an investment opportunity that will

Q48: The present value of an investment that

Q59: Which of the following is true of

Q64: Which of the following statements is FALSE?<br>A)When

Q72: Which of the following statements is FALSE?<br>A)The

Q78: Wyatt Oil is contemplating issuing a 20-year