Multiple Choice

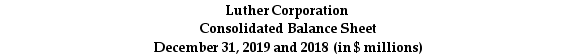

Use the table for the question(s) below.

Consider the following balance sheet:

-Luther Corporation's stock price is $39 per share and the company has 20 million shares outstanding.Its Debt -Capital Ratio for 2019 is closest to:

Grasp the concept of mergers, acquisitions, and the role of board and shareholder approvals in these transactions.

Identify the legal consequences of corporate actions, including asset sales and liabilities.

Comprehend the processes and legal framework governing mergers and acquisitions, including shareholder rights.

Understand the strategies and legal considerations involved in corporate takeovers and defenses against them.

Definitions:

Related Questions

Q8: The forward rate for year 4 (the

Q14: The intent of umbrella branding is to

Q15: Assuming you just purchased 10,000 Bbls of

Q23: Mini-Case Question.What is the marketing ROI for

Q27: Stephen bought a new Chevrolet Suburban vehicle

Q28: A low-cost leader in a market is

Q48: Identify the operational components of channel performance.Explain

Q57: If you take the $2500 rebate and

Q68: In addition to the balance sheet,income statement,and

Q78: Luther's current ratio for 2019 is closest