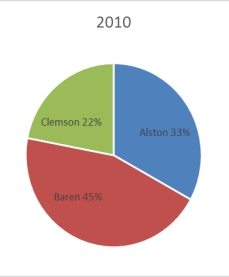

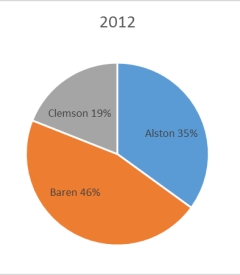

The 2010 and 2012 market share data of three competitors (Alston, Baren, and Clemson) in an oligopolistic industry are presented in the following pie charts.Total sales for this industry were $1.5 billion in 2010 and $1.8 billion in 2012.Clemson's sales in 2010 were ___________.

Definitions:

Conglomerate Merger

A combination of two companies that are involved in totally unrelated business activities.

Marketing Chain

The series of processes and activities involved in moving a product from producer to consumer, including distribution and selling.

Vertical Merger

A merger between companies in the same industry but at different stages of the production process, such as a manufacturer merging with a supplier.

Horizontal Merger

A business consolidation that occurs between firms operating in the same industry.

Q1: Which of the following measurement processes is

Q26: Consider the following frequency distribution:

Q34: Something to be avoided during an interview

Q37: The law of multiplication gives the probability

Q40: The probability of selecting 2 baseball players

Q60: Which of the following is not true

Q63: The following graphic of residential housing data

Q78: A person has decided to construct a

Q98: A market research team compiled the

Q98: Abel Alonzo, Director of Human Resources,