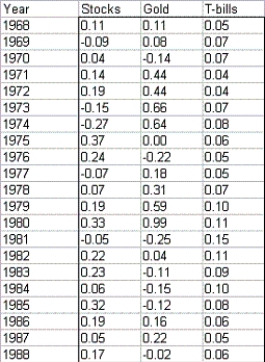

Your parents are discussing their retirement portfolio with you so that you can be informed not only about their holdings,but learn how to manage your own.The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them.Suppose your dad asks you to determine what percentage of his money he should have invested in T-bills,gold,and stocks in the 1980s and 1990s based on data he provides for the years 1968-1988.The table below lists the annual returns (percentage changes in value)for these investments during these years.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your parents' money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on their portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your parents' money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on their portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Definitions:

Q4: A regression analysis between X = sales

Q5: Briefly relay the history of the director's

Q6: What is one assumption of two-way ANOVA

Q16: "Tactics" refers to<br>A)the methods actors use to

Q20: An informal test for normality that utilizes

Q33: Which of the following is true of

Q41: Confidence intervals are a function of the<br>A)population,the

Q48: In general,increasing the confidence level will narrow

Q49: If we want to model the time

Q60: Every form of exponential smoothing model has