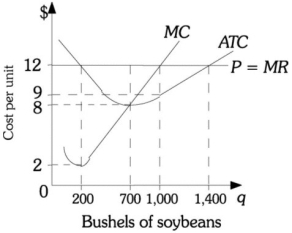

Refer to the information provided in Figure 8.8 below to answer the question(s) that follow.  Figure 8.8

Figure 8.8

-Refer to Figure 8.8. At the market price of $8 per bushel, if this farmer produces the profit-maximizing level of soybeans, the total revenue would be

Definitions:

Perceptions

The way in which something is regarded, understood, or interpreted by individuals based on their sensory experiences and cognitive processes.

Individual Resistance

Individual resistance refers to the opposition or pushback from a person against proposed changes or new ideas, often due to personal discomfort or fear of the unknown.

Economic Reasons

Factors related to financial considerations, such as cost-effectiveness, profitability, and economic viability, influencing decisions or actions.

Power And Influence

The capacity to affect the behavior of others or the course of events, often through authority, persuasion, or leadership.

Q11: Assume Cathy's Cupcake Company operates in a

Q23: If the marginal product of labor is

Q39: Refer to Figure 7.4. The average product

Q47: The Lawn Ranger, a landscaping company, has

Q75: New investors are not attracted to an

Q147: Refer to Figure 8.5. If one drone

Q199: In efficient markets, _ flows toward _

Q202: Refer to Table 8.3. If the firm

Q308: If revenue is less than _, profit

Q325: When a decrease in the scale of