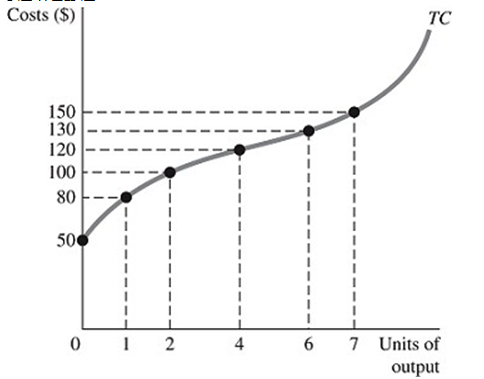

Refer to the short-run information provided in Figure 8.5 below to answer the question(s) that follow

Figure 8.5

-Refer to Figure 8.5. If one drone is produced, total variable costs are

Definitions:

Social Security Withholding

The process by which employers deduct a portion of an employee's salary to contribute to the Social Security program.

Federal Income Tax Withholding

The amount of federal income tax withheld from an employee's paycheck, based on their earnings and tax filing status.

Net Pay

The amount of money remaining from an employee's gross pay after deductions like taxes, insurance premiums, and retirement contributions have been subtracted.

FICA Tax

A U.S. federal payroll (or employment) tax imposed on both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, disabled people, and children of deceased workers.

Q21: If the average variable cost of the

Q24: The Razor-Thin Disposable Razor Company is a

Q60: In the short run, a firm<br>A) has

Q78: Amy spends $6,000 on remodeling a storefront

Q165: The short-run average total cost curve eventually

Q168: Refer to Scenario 9.4. The annual total

Q194: Refer to Scenario 9.10. The economic profit

Q256: The marginal cost curve of a firm

Q276: At the Larson Bakery the marginal products

Q319: Refer to Scenario 9.3. The restaurant is