Refer to the information provided in Scenario 22.5 below to answer the question(s) that follow.

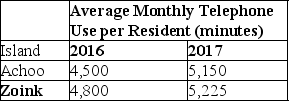

SCENARIO 22.5: The tiny nation of Bugaboo consists of two virtually identical islands, Achoo and Zoink, separated by the Strait of Dingo. The islands are similar in geography and population. The only telephone service on the islands is cellular, and the only cellular provider on the islands is the government-owned Bugaboo Communications Company, which charges a standardized rate of 20 Bugabucks per minute. Both islands add on an additional $5 Bugabucks-per-minute usage tax. As a way to increase revenue, the island governor of Zoink decided to increase the usage tax to $10 per minute, effective January 1, 2017. The average monthly cellphone usage per month is listed in the table below.

-Refer to Scenario 22.5. The total cost of telephone service for residents of Achoo in 2017 is ________ Bugabucks.

Definitions:

Labor Efficiency Variance

measures the difference between the actual hours worked to produce goods and the standard hours expected, multiplied by the standard labor rate.

Direct Labor-Hours

The hours worked by employees directly involved in the production process.

Variable Overhead Efficiency Variance

A metric that measures the difference between the actual hours taken to produce something and the expected (standard) hours, multiplied by the variable overhead rate per hour.

Standard Machine-Hours

The allocated number of operating hours expected for machinery to achieve a set level of production under standard conditions.

Q48: Refer to Table 3.1. In this market

Q50: We reject the null hypothesis of no

Q80: The benefit of a price floor to

Q85: Regression discontinuity is a method in which

Q145: If a price ceiling is set above

Q169: Refer to Figure 20.1. The opportunity cost

Q186: Refer to Figure 3.4. If consumer income

Q196: Refer to Figure 20.4. The domestic price

Q266: Inferior goods are also known as substitute

Q284: Refer to Figure 3.13. Assume hamburgers are