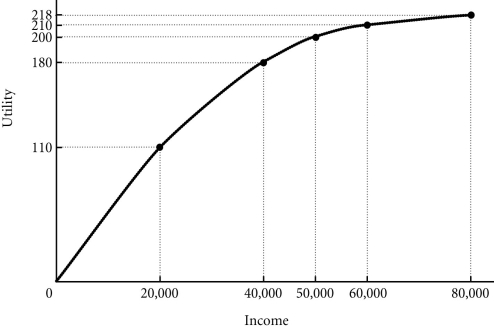

Refer to the information provided in Figure 17.1 below to answer the question(s) that follow.  Figure 17.1

Figure 17.1

-Refer to Figure 17.1. John has two job offers when he graduates from college. John views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $50,000. The second offer is at a fixed salary of $20,000 plus a possible bonus of $60,000. John believes that he has a 50-50 chance of earning the bonus. What is John's expected utility for each job offer?

Definitions:

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to use and wear and tear.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Deferred Tax Asset

A financial statement item that represents an entity's right to reduce future tax payments due to temporary differences or certain carryover losses.

Deferred Tax Liability

A tax obligation recognized in the financial statements representing taxes that are owed but not yet paid.

Q5: Refer to the Economics in Practice on

Q7: If there are no externalities, producing where

Q20: Refer to Figure 16.1. Absent government intervention,

Q108: Easy entry of new firms is not

Q129: If a tax is placed on perfectly

Q138: All of the following statements are true

Q152: Vertical equity holds that<br>A) those with equal

Q180: Refer to Scenario 19.4. How much total

Q185: Recall the Economics in Practice on page

Q260: The impossibility theorem is the idea that<br>A)