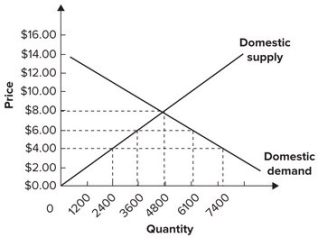

Refer to the graph shown for a small country that is a price taker internationally.  Assume the foreign supply of this product is perfectly elastic at a price of $4 per unit. Starting from a free trade equilibrium, an import quota of 2,500 would cause domestic consumption to:

Assume the foreign supply of this product is perfectly elastic at a price of $4 per unit. Starting from a free trade equilibrium, an import quota of 2,500 would cause domestic consumption to:

Definitions:

Income Subsidy

An income subsidy is a government-provided financial assistance program intended to boost an individual's income to a level sufficient for meeting basic living standards.

Negative Income Tax

A program where the government provides additional income to those who earn under a specific threshold, rather than collecting taxes from them.

Tax Liability

Tax liability is the total amount of tax that an individual or organization is legally obligated to pay to a taxing authority based on earnings, property ownership, or other taxable conditions.

Earned Income Tax Credit

A tax credit in the United States designed to benefit individuals and families with low to moderate incomes, effectively reducing the amount of tax owed and possibly resulting in a refund.

Q1: In a perfectly competitive market, the demand

Q21: Refer to the table shown. At

Q26: Refer to the graph shown. If the

Q26: At the minimum efficient level of production:<br>A)

Q28: Which of the following statements is true?<br>A)

Q62: Refer to the graph shown. The marginal

Q82: All of the following are considered sources

Q102: A production table can be used to

Q137: If the benefit of a public good

Q166: Given the same supply elasticity, the