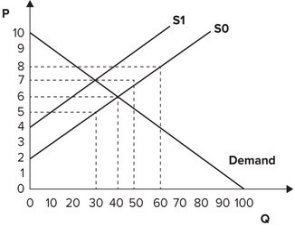

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, the deadweight loss from the tax will be:

Definitions:

Transaction Costs

Expenses incurred during the buying or selling process, not limited to the price of the good, like fees, taxes, or other costs associated with the transaction.

Middlemen

Intermediaries or agents who facilitate transactions between producers and consumers by buying goods from producers and selling them to consumers, often adding value through services like transportation or storage.

Transaction Costs

Expenses incurred during the process of buying or selling goods and services, which may include fees, taxes, or other costs.

Comparative Advantage

The theory suggesting that countries or entities benefit and gain efficiency from specializing in the production of goods or services for which they have a lower opportunity cost.

Q10: If the United States were to stop

Q27: Refer to the graph shown. Total revenue

Q59: According to the law of supply:<br>A) supply

Q78: Refer to the graph shown. If government

Q79: Refer to the graph shown. If the

Q104: Assuming a binding price floor, the more

Q119: Refer to the graph shown. Calculate the

Q131: A market incentive plan:<br>A) regulates the amount

Q135: If the government imposes an excise tax

Q163: If the supply curve is perfectly elastic,