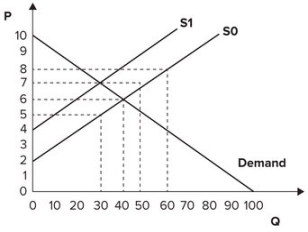

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, the equilibrium price will change to:

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of any additional dollar of income that will be paid in taxes.

State-Run Lotteries

Government-operated lotteries, which serve as a revenue source for the state, typically contributing to public sectors such as education.

Higher-Income Families

Refers to households that have an income level significantly above the median or average income for their area or country.

Local Governments

Governmental authorities that operate at a level below the state or national, managing local affairs such as city, town, or village administration.

Q1: An effluent fee is an example of:<br>A)

Q8: Suppose that initially, the equations for demand

Q8: Refer to the table shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7145/.jpg"

Q13: A person who has auto insurance is

Q14: One reason trade restrictions exist is that:<br>A)

Q72: World trade declined in the 1930s. Which

Q77: An optimal policy is one in which

Q88: If cigar prices tripled while sales of

Q107: Refer to the graph shown. When the

Q165: Refer to the graph shown. When price