Source: Data from Lawrence Baum.

Source: Data from Lawrence Baum.

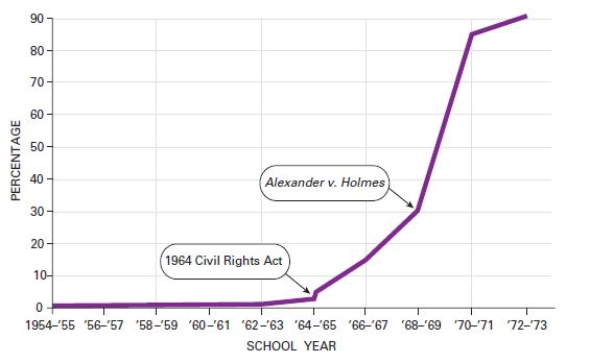

-Which of the following contributed to the Supreme Court's decision in Alexander v.Holmes?

Definitions:

Deferred Tax Assets

Future tax benefits arising from situations where the amount of taxes paid on financial statements exceeds the amount owed for tax purposes, which can be used to reduce future tax liability.

Deferred Tax Liabilities

Deferred tax liabilities are taxes that have been accrued but will not be paid for until a future date, typically due to timing differences between accounting and tax laws.

Effective Tax Rates

The average percentage at which an individual or corporation is taxed.

Statutory Tax Rates

The tax rate legally imposed on income or profits by the government, which can vary depending on the type of income, entity, or other factors.

Q1: Water vapor is continuously added to the

Q1: Which of the following did the Supreme

Q11: Relative humidity = [ _ / saturation

Q12: How does this image symbolize the end

Q14: Margaret Davis' studies on lake pollen sediments

Q20: Which of the following would most likely

Q31: Saturation water vapor pressure<br>A)increases with temperature.<br>B)decreases with

Q33: How does the skunk cabbage maintain

Q34: How does the photo illustrate a "rally

Q45: On which of the following constitutional principles