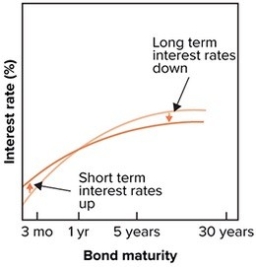

The graph below shows what happens when the Fed implements:

Definitions:

Maturity

The date on which the principal amount of a financial instrument, such as a bond or loan, becomes due and payable.

Bond Portfolios

Collections of bonds held by investors or institutions, designed to achieve certain financial goals while managing risk and return.

Indexing

The investment strategy of replicating the performance of a market index, often through passive fund management.

Duration

A measure of the sensitivity of the price of a bond or a fixed income portfolio to changes in interest rates.

Q15: Excess reserves equal:<br>A)total deposits.<br>B)total deposits minus required

Q22: The main difference between quantitative easing and

Q25: News Story: Workers at a car-manufacturing plant

Q51: Which of the following statements about government

Q57: The Glass-Steagall Act was set up to:<br>A)regulate

Q77: Other things equal, the higher the reservation

Q105: Suppose the required reserve ratio is 0.15.

Q106: How can monetary policy be designed to

Q117: Refer to the graph shown. Which of

Q132: Checking account deposits are classified as money