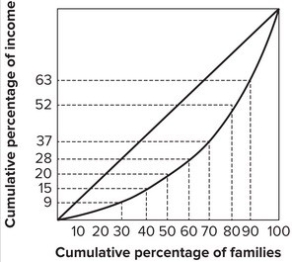

Refer to the graph shown.  The poorest 30 percent of the families earn:

The poorest 30 percent of the families earn:

Definitions:

Ability to Pay

The principle suggesting that taxes should be levied according to an individual's or entity's capacity to pay, typically related to income or wealth levels.

Progressive Income Tax

A tax system where the tax rate increases as the taxable income increases, aimed at redistributing income more equitably.

Ability-to-Pay Principle

A taxation principle suggesting that taxes should be levied based on an individual's or entity's ability to pay, often implying higher rates for higher income levels.

Tax Equity

The fairness of a tax system, judged by how evenly or proportionately tax burdens are distributed among different groups of taxpayers.

Q46: Consider the following payoff matrix facing

Q49: Nudges can be used by:<br>A)firms only.<br>B)firms, but

Q52: Describe five major U.S.expenditure programs that are

Q66: All of the following are examples of

Q71: In a dynamic context, firms concentrate on:<br>A)long-run

Q88: The National Hockey League locked out the

Q99: In choosing between two products, a rational

Q105: To remedy unfairness in the distribution of

Q125: Refer to the graphs shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7143/.jpg"

Q140: Discrimination based on individual characteristics that don't