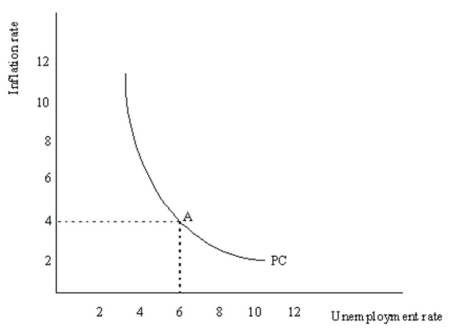

Consider the following Phillips curve diagram:  (a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(b) How would your answer to (a) above change if you were to take into account potential changes in inflation expectations and their impact on actual inflation?

Definitions:

Personal Income Tax

A tax levied on individuals or households based on the level of their income.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government, after deductions and exemptions.

Marginal Tax Rate

It is the rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your income for each tax bracket in which you qualify.

Taxable Income

The amount of income subject to taxes, after all deductions and exemptions are taken into account.

Q1: All of the following are related to

Q2: A normal distribution curve will have 99.7%

Q5: The _ is one of the most

Q8: A patient with AML is likely to

Q9: Why do economists worry more about the

Q14: Suppose the market for Japanese yen is

Q19: Which of the following is the most

Q20: Does inflation actually wipe out the real

Q23: If a country wants to fix its

Q59: This polymer would be classified as a