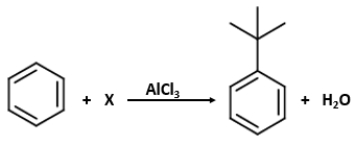

Identify "X" in the given reaction.

Definitions:

Deferred Tax Asset

An accounting item on the balance sheet that represents a future tax payment obligation to the IRS, which results in reduced taxes payable in future periods.

Income Tax Liability

The amount of tax that an individual or corporation owes to the government based on their income earnings for the fiscal year.

Deferred Tax Liability

A tax obligation that a company owes but is not yet required to pay, resulting from temporary differences between the company's accounting and tax treatment of assets and liabilities.

Revenue

The total income generated by a company from its normal business operations.

Q1: Which of the following statements is not

Q5: What is the E/Z configuration of the

Q24: Consider the following form of phenylalanine. <img

Q32: The product of the following reaction would

Q39: What is the major organic product obtained

Q50: 205<sup>o</sup>C<br>A)CH3COOH<br>B)CH3(CH2)2COOH<br>C)CH3(CH2)4COOH<br>D)CH3CH2COOH

Q64: What is the IUPAC name of the

Q65: An aldol condensation using 3-methylbutanal could produce

Q69: Which of the following amino acids is

Q69: This reaction is an example of _.<br>A)