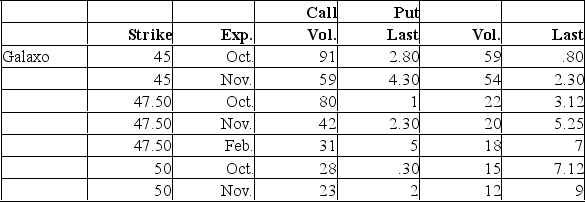

Underlying stock price: 45.80  Suppose you bought 10 Glaxo Nov 50 put contracts. Just before the option expires, the stock is selling for $55. What is your net profit (or loss) ? Ignore transaction costs.

Suppose you bought 10 Glaxo Nov 50 put contracts. Just before the option expires, the stock is selling for $55. What is your net profit (or loss) ? Ignore transaction costs.

Definitions:

Continuous Reinforcement

A learning schedule in which every correct response is followed by a reward, facilitating rapid acquisition of a new behavior.

Ratio Reinforcement

A type of operant conditioning reinforcement schedule in which a response is reinforced only after a specified number of responses have occurred.

Interval Reinforcement

A type of operant conditioning scheduling wherein rewards are given to an organism at variable time intervals to encourage behavior.

Partial Reinforcement

A conditioning schedule in which a behavior is reinforced only some of the time, making the behavior more resistant to extinction.

Q1: The AIDA model is comprised of four

Q6: List and describe two major audiences that

Q15: Of the following statements regarding e-mail, which

Q29: _ is a cross-functional process for planning,

Q133: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" For purposes of

Q137: When the exercise price is increased, it

Q152: Given that the underlying stock price is

Q182: When the value of the underlying asset

Q199: You are the buyer for a cereal

Q251: Suppose a firm has a total market