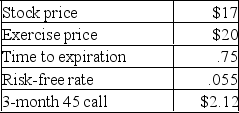

What is the value of a 9-month put with a strike price of $20 given the Black-Scholes Option Pricing Model and the following information?

Definitions:

Federal Deposit Insurance

A government guarantee that protects bank depositors' funds up to a certain limit in case of a bank failure.

Bank Panics

Events in which a large number of bank customers withdraw their deposits simultaneously due to fears that the bank will become insolvent.

Money Supply

The total amount of money available in an economy at a particular point in time, including cash, bank deposits, and other liquid assets.

Interest Rate

The percentage of a sum of money charged for its use, usually expressed on an annual basis.

Q5: A buyer of which one of the

Q13: Warrants include an implicit call option.

Q27: A firm has stock outstanding with a

Q29: Considering social ads, a "social graph" is

Q34: Implementation costs creates limits to arbitrage.

Q53: An American option is worth more than

Q107: Which of the following best defines a

Q196: The formula C<sub>0</sub><sub> </sub>>= (S<sub>0</sub> + E)

Q248: What is the closing value on this

Q374: If a call is in the money