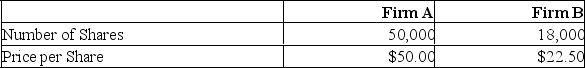

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the value of firm B to firm A?

What is the value of firm B to firm A?

Definitions:

Opportunity Cost

The cost associated with not choosing the next best alternative when making a decision, representing the benefits one could have received by taking an alternative action.

Alternative Use

The value or potential benefit that is foregone as a result of using an asset or resource in a particular way instead of another possible way.

Sunk Costs

are past expenses that have already been incurred and cannot be recovered or changed, and thus should not affect future business decisions.

Avoidable Costs

Expenses that can be eliminated if a particular decision is made, not incurred in the absence of the decision.

Q30: A lease is a contract between the

Q75: Options contracts are a zero sum game.

Q104: Which one of the following methods of

Q119: Principal, Inc. is acquiring Secondary Companies for

Q185: You grow wheat and figure that you

Q189: Your firm needs to either buy or

Q201: All else the same, the value of

Q268: Which of the following best defines an

Q276: Given the following information, what is the

Q283: Compare and contrast the advantages of a