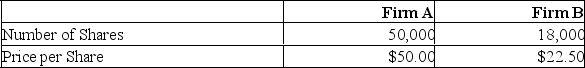

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the price per share of the merged firm after the acquisition is completed?

What is the price per share of the merged firm after the acquisition is completed?

Definitions:

Regression Line

A line of best fit through a scatter plot of data points that shows the relationship between two variables.

API Gravity Degrees

A measure of how heavy or light a petroleum liquid is compared to water.

Oil Quality

A measure of the physical and chemical properties of oil, indicating its suitability for various uses or its compliance with standards.

Price Per Barrel

The cost of a barrel of commodities like oil, typically used as a benchmark for pricing.

Q17: Suppose you have the following information concerning

Q57: DogChew Products needs to replace its rawhide

Q93: You sell 10 gold futures contracts when

Q109: Cereal Delites uses corn as the primary

Q119: Maxine's is considering either purchasing or leasing

Q121: The reason for "hiding" a financial lease

Q189: Synergistic benefits can often be realized by

Q189: Your firm needs to either buy or

Q228: Provide a definition of a leveraged lease.

Q300: All of the following are possible cash