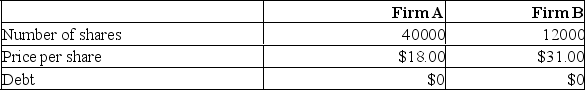

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  How many shares of outstanding stock will firm AB have if the merger is a cash deal?

How many shares of outstanding stock will firm AB have if the merger is a cash deal?

Definitions:

Earnings Per Share

Earnings Per Share (EPS) is a financial ratio that indicates the portion of a company's profit allocated to each outstanding share of common stock, serving as an indicator of the company's profitability.

Dividend Paid

Cash payment distributed to shareholders out of a company’s earnings, reflecting a return on the investment made in the company's equity.

Repurchase Outstanding

A corporate finance strategy where a company buys back its own shares from the marketplace, reducing the number of outstanding shares.

Current Ratio

A ratio that determines a company's capacity to fulfill immediate financial commitments using its present assets.

Q8: Maxine's is considering either purchasing or leasing

Q23: Explain the difference between a swap contract

Q55: Provide a suitable definition of basis risk.

Q75: Kevin owns a call option which will

Q109: Cereal Delites uses corn as the primary

Q140: Which one of the following statements concerning

Q201: DogChew Products needs to replace its rawhide

Q256: Provide four primary benefits to leasing.(Should be

Q260: Which one of the following actions will

Q293: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the