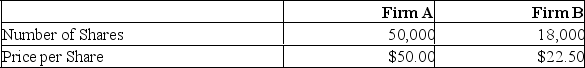

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the NPV of acquiring Firm B?

What is the NPV of acquiring Firm B?

Definitions:

Ear Canal

The tube that runs from the outer ear to the eardrum, transporting sound waves to the eardrum.

Sensorineural Hearing Loss

Hearing loss that occurs when neural structures associated with the ear are damaged. Neural structures include hearing receptors and the auditory nerve.

Conductive Hearing Loss

A type of hearing loss that occurs when sound waves cannot be conducted through the ear. Most types are temporary.

Tuning Fork

A tool made of metal with two prongs, used primarily to produce a specific tone or pitch for tuning musical instruments, as well as for auditory testing and in healing practices.

Q9: Provide a definition of a split-up.

Q78: If the lease term is at least

Q92: An acquisition of a firm through the

Q122: Which of the following is the best

Q179: The intrinsic value of a call option

Q200: You sold (wrote) a May American call

Q228: Calipers, Inc. is acquiring Johnson Warehouse for

Q239: Your company is considering the purchase of

Q251: S&P 500 INDEX (CME); $500 times index

Q285: Tuesday's and Thursday's are all-equity firms. Tuesday's