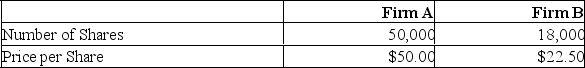

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the price per share of the merged firm after the acquisition is completed?

What is the price per share of the merged firm after the acquisition is completed?

Definitions:

Big Five

A model outlining five broad dimensions of personality: openness, conscientiousness, extraversion, agreeableness, and neuroticism, used to describe human personality.

Neuroticism

A personality trait characterized by long-term tendencies towards anxiety, depression, and other negative emotions.

Conscientiousness

A personality trait characterized by diligence, carefulness, and a desire to do a task well.

Filial Loyalty

The devotion, duty, and respect that a child typically shows towards their parents.

Q38: In general, the evidence indicates that mergers

Q62: You own a high-tech manufacturing entity. You

Q112: Operating leases:<br>A) Are never cancellable.<br>B) Are always

Q123: The most cited reason why firms enter

Q125: Revenue enhancement represents a synergistic benefits from

Q181: Provide a suitable definition of swap contract.

Q196: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q209: Black Hammer Tools is contemplating the acquisition

Q212: Neither acquiring firm A nor target firm

Q261: Which one of the following statements is