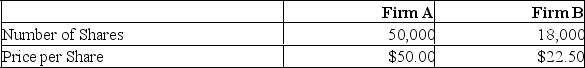

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the merger premium per share in this case?

What is the merger premium per share in this case?

Definitions:

Worker Empowerment

Strategies and practices that give employees more autonomy, authority, and control over their work and decision-making processes.

Horizontal Structure

An organizational design that focuses on teamwork and collaboration rather than a traditional hierarchical system, often found in flatter organizations.

Division of Labour

The assignment of different parts of a manufacturing process or task to different people in order to improve efficiency.

Personal Coordination

The organization and management of an individual's tasks and responsibilities to achieve efficiency and fulfill objectives.

Q14: An interest rate _ is a call

Q53: The value of a strategic fit is

Q72: Calvada Productions signs a lease agreement with

Q91: A key difference between an option contract

Q147: When the existing management of a firm

Q164: Which one of the following is the

Q169: Which of the following is the best

Q175: An option contract can be used to

Q300: An option contract can be based on

Q330: An argument against using an acquisition by