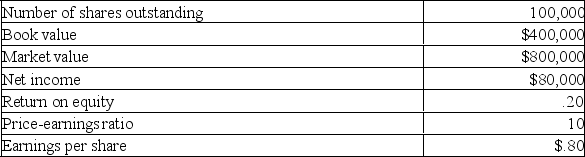

A Toronto firm is considering a new project which requires the purchase of $250,000 of new equipment. The net present value of the project is $100,000. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

Definitions:

Q5: Nexum Inc. has a target debt-equity ratio

Q88: To reduce repetitive filing requirements for new

Q98: Sun Lee Importers has a cost of

Q118: Given the following information, what is JEM

Q148: Lagoon Boat Sales has 300,000 shares of

Q206: A firm has 100,000 shares of common

Q240: Volatility of earnings will affect the optimal

Q278: A public offering of equity by a

Q309: References regarding how successful the venture capitalist

Q334: Financial risk is wholly dependent upon the