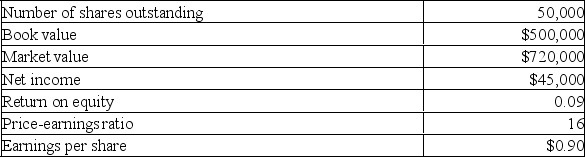

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. What will the new book value per share be after the project is implemented given the following current information on the firm?

Definitions:

Taxes Combined

A calculation that aggregates all applicable taxes (federal, state, local) on an individual or entity's income.

Effective Tax Rate

The average percentage of income paid to the government in taxes, considering all deductions and credits.

Future Value

The value of a current asset at a specified date in the future based on an assumed rate of growth over time.

Deferral of Taxes

The postponement of taxes to a future period, commonly used in retirement savings plans and investment accounts.

Q25: The Rose Bush has a cost of

Q48: The Adept Co. has paid annual dividends

Q95: Merci Industries is selling 2,500 shares of

Q226: Provide a definition for the term syndicate.

Q255: Which of the following regarding rights offerings

Q259: The cost of equity is affected by

Q261: The Wisdom Company has 1.5 million shares

Q274: A corporation's first sale of equity made

Q314: Jones Men's Wear would like to expand

Q322: Loss of key employees is an indirect