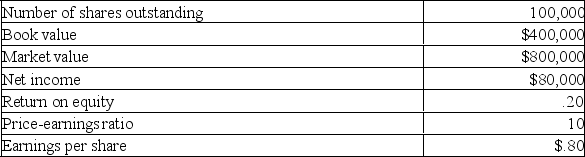

A Toronto firm is considering a new project which requires the purchase of $250,000 of new equipment. The net present value of the project is $100,000. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

Definitions:

Sexual Harassment

Unwelcome sexual advances, requests for sexual favors, and other verbal or physical harassment of a sexual nature.

Opposite Sex

A term often used to describe individuals of the gender different from the speaker's identification.

Online Activities

Tasks or engagements conducted over the internet, ranging from work and research to socializing and entertainment.

Learned Trait Anxiety

Anxiety that develops over time through experiences and learning, rather than being inherent or innate.

Q35: In relation to M&M Proposition II with

Q79: Exley's Farms has a debt-equity ratio of.75.

Q80: The Delta Co. owns retail stores that

Q87: A large tax loss carry forward will

Q149: The Wrangler Co. has expected EBIT =

Q152: M&M Proposition II with no tax states

Q286: A report given to potential investors that

Q288: Which of the following best defines the

Q307: As the debt-equity ratio of a firm

Q321: What are the pros and cons of