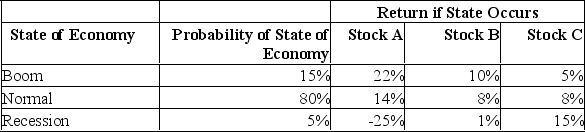

What is the expected return on a portfolio which is invested 35% in stock A, 45% in stock B, and 20% in stock C?

Definitions:

Oligopoly Market

A market structure characterized by a small number of firms that dominate the market, leading to competitive yet interdependent market conditions.

Monopolistically Competitive Market

An economic scenario where numerous companies offer products that are alike but not exactly the same, leading to competition based on aspects other than price.

Monopolistic Market

An economic scenario where only one seller provides a distinctive product or service, facing substantial obstacles that prevent other competitors from entering the market.

Purely Competitive Market

A market structure characterized by many buyers and sellers, free entry and exit, and products that are perfect substitutes.

Q16: You want your portfolio beta to be

Q19: Which of the following best defines the

Q40: In a highly diversified portfolio, the standard

Q42: A stock has a beta of 1.4.

Q91: According to the CAPM, the expected return

Q99: Asset A has an expected return of

Q139: What percentage of the population is represented

Q184: Dexter United has a debt-equity ratio of.70

Q202: An investor purchased a stock for $1.61

Q345: Provide a definition for economic value added